|

Quote:

|

|

Looks like the system is going to be reviewed to deal with this madness.

|

Quote:

|

Girl dealing with my application is off sick so nothing's happenedsince I last rang. Donna said she would take it over and she would get it upstairs as soon as possible.

Meanwhile I have a stinker of a cold, probably from sitting outside on the drive cleaning and painting engine parts to keep me busy.:( Bits of engine look good though! :) |

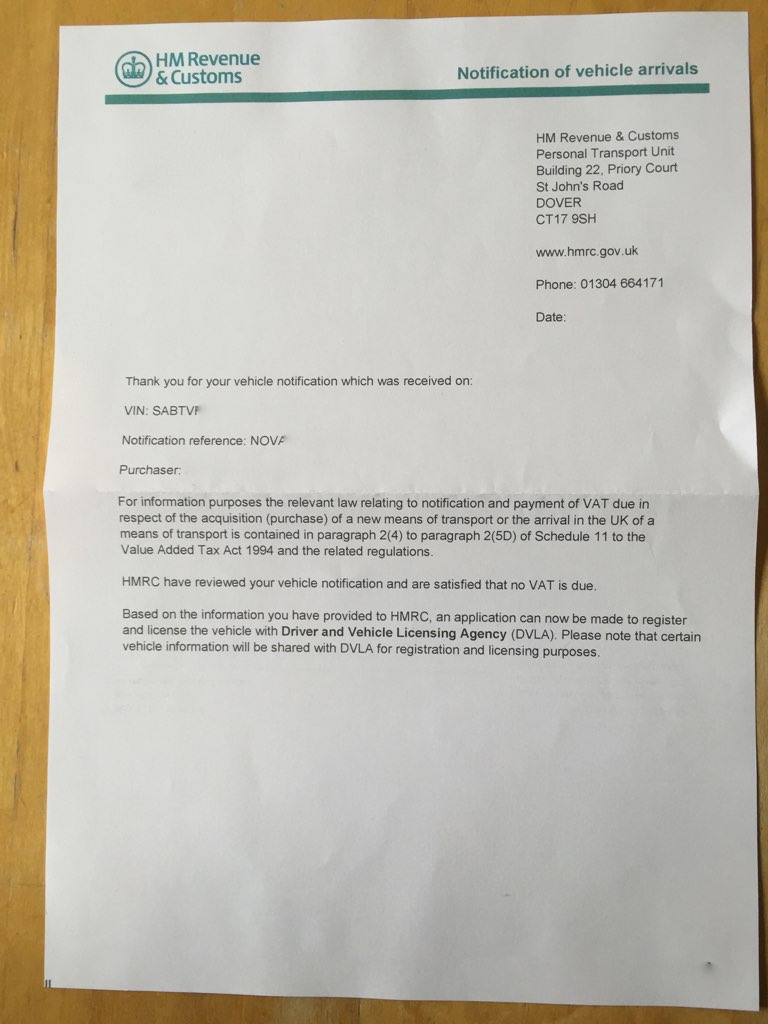

Got this in the post today.....

What a surprise! No VAT due! |

Even this letter is not accurate.

"(4)Regulations under this paragraph may make provision in relation to cases where— (a)any goods which are subject to a duty of excise or consist in a new means of transport are acquired in the United Kingdom from another member State by any person; (b)the acquisition of the goods is a taxable acquisition and is not in pursuance of a taxable supply; and (c)that person is not a taxable person at the time of the acquisition, for requiring the person who acquires the goods to give to the Commissioners such notification of the acquisition, and for requiring any VAT on the acquisition to be paid, at such time and in such form or manner as may be specified in the regulations. (5)Regulations under this paragraph may provide for a notification required by virtue of sub-paragraph (4) above— (a)to contain such particulars relating to the notified acquisition and any VAT chargeable thereon as may be specified in the regulations; and (b)to be given, in prescribed cases, by the personal representative, trustee in bankruptcy, interim or permanent trustee, receiver, liquidator or person otherwise acting in a representative capacity in relation to the person who makes that acquisition." There is no paragraph 2 (5D) or (5C) for that matter!:rolleyes: |

Here is a section from the NOVA document that again doesn't apply to me!

"How will component parts brought in from either insider or outside of the EU for incorporation into a restoration project be treated? If a business or private individual buys new or used component parts (from suppliers outside of the EU or from another Member state of the EU) and these parts are incorporated in to a restoration project vehicle which will eventually be licensed and registered by the DVLA, a NOVA declaration will not be required. Component parts that are imported from a country outside of the EU will be liable to import VAT and customs duty and should be correctly classified at the time of importation. Component parts imported into the UK from a another member state of the EU may be subject to acquisition tax but this will depend on the tax status of the goods at the time of supply and whether the supply is to a VAT registered business or a business not VAT registered or a private individual. Where a chassis (or frame) with sufficient major components are imported from outside the EU or from another Member State in the same consignment (as discussed above) they will not be regarded as component parts for NOVA purposes. Kit Cars If the components within the kit would be sufficient to constitute a complete vehicle if already assemble (see above) the Kit car must be notified into NOVA by a VAT registered business. If the Kit is imported from a country outside of the EU by a private individual Customs duty and import VAT will be payable and HMRC will make the NOVA notification on your behalf from the import declaration." |

This is the only bit that could possibly apply to me but (1) it isn't a restoration, (2) There is no evidence it came from outside the UK!!! I still don't get it!:confused:

"How do I make a NOVA notification for a restoration project vehicle? If a complete vehicle or component parts with the essential characteristics of a vehicle are imported from outside of the EU, a VAT registered business must make a NOVA notification. However, the HMRC NCH will make the notification on behalf of private individuals or non-VAT registered businesses. If a complete vehicle or component parts with the essential characteristics of a complete vehicle are brought to the UK from another member state of the EU the NOVA notification must be made irrespective of whether the vehicle is brought in by a VAT registered business, non-VAT registered business or private individual. In some instances a VAT registered business or non-VAT registered business/private individual (where required) may have insufficient information to make an electronic notification into NOVA, because the restoration project may have commenced before the introduction of NOVA or the vehicle was purchased in the UK partially restored and they do not know the origin of the imported vehicle and were not given any documentation showing the vehicle has been already notified into NOVA. In such circumstances a paper NOVA 1 form should be submitted, completed as fully as possible with the information available. Copies of the receipts for parts you have purchased should be included to prove that the vehicle is a restoration project." |

Good news, I have been given my new AGE RELATED PLATE number, just waiting for a call back with the V5 ref and I'll be off to the local ford dealer to have plates made. Then just need to wait for an emailed updated cover note with the reg on and I can go for a drive! Can't quite believe it! :D Weather permitting!

|

| All times are GMT +1. The time now is 03:56 AM. |

Powered by vBulletin® Version 3.6.4

Copyright ©2000 - 2024, Jelsoft Enterprises Ltd.